Incorporating automated welding equipment to your shop can be an excellent solution to a variety of common issues such as high scrap costs & slow production. It’s also a way to combat the welder shortage that’s plaguing the industry.

The cost of new welding equipment it often a limiting factor—this is where Section 179 comes in! This tax code allows you to save on modernizing your shop in 2022. Read on to learn how you can take advantage of this benefit before the end of the year.

What is Section 179?

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment (purchased or financed) during the tax year. For example, if you purchase a piece of qualifying automated welding equipment, you can deduct the full price from your gross income. This is an incentive created by the US government to support businesses investing in themselves.

Section 179 is one of the few incentives available to small businesses. It’s a great benefit that could save you thousands!

Read more about Section 179 Here

How it Works

In 2022, Section 179 allows you to write-off up to $1,080,000 of a qualifying equipment purchase. This annual deduction amount is up from $1,040,000 in 2020.

In the past, manufactures would write off a purchase little by little through depreciation. For example, if you spent $100,000 on a piece of welding machinery, you might write off $25,000 per year for five years.

When you utilize Section 179 in 2022, you can write off the entire amount in the same tax year. Take the same $1000,000 piece of equipment and write off all of the $100,000 in 2022. This is a huge tax deduction for small and mid-sized businesses to take advantage of!

The Details for 2022

Automated welding machinery and accessories can qualify for the Section 179 deduction as long as the below requirements are met:

- Equipment must be purchased, financed or leased

- Equipment must be installed and ready for service in the same tax year.

- More than 50% of the use of the equipment must be used for business.

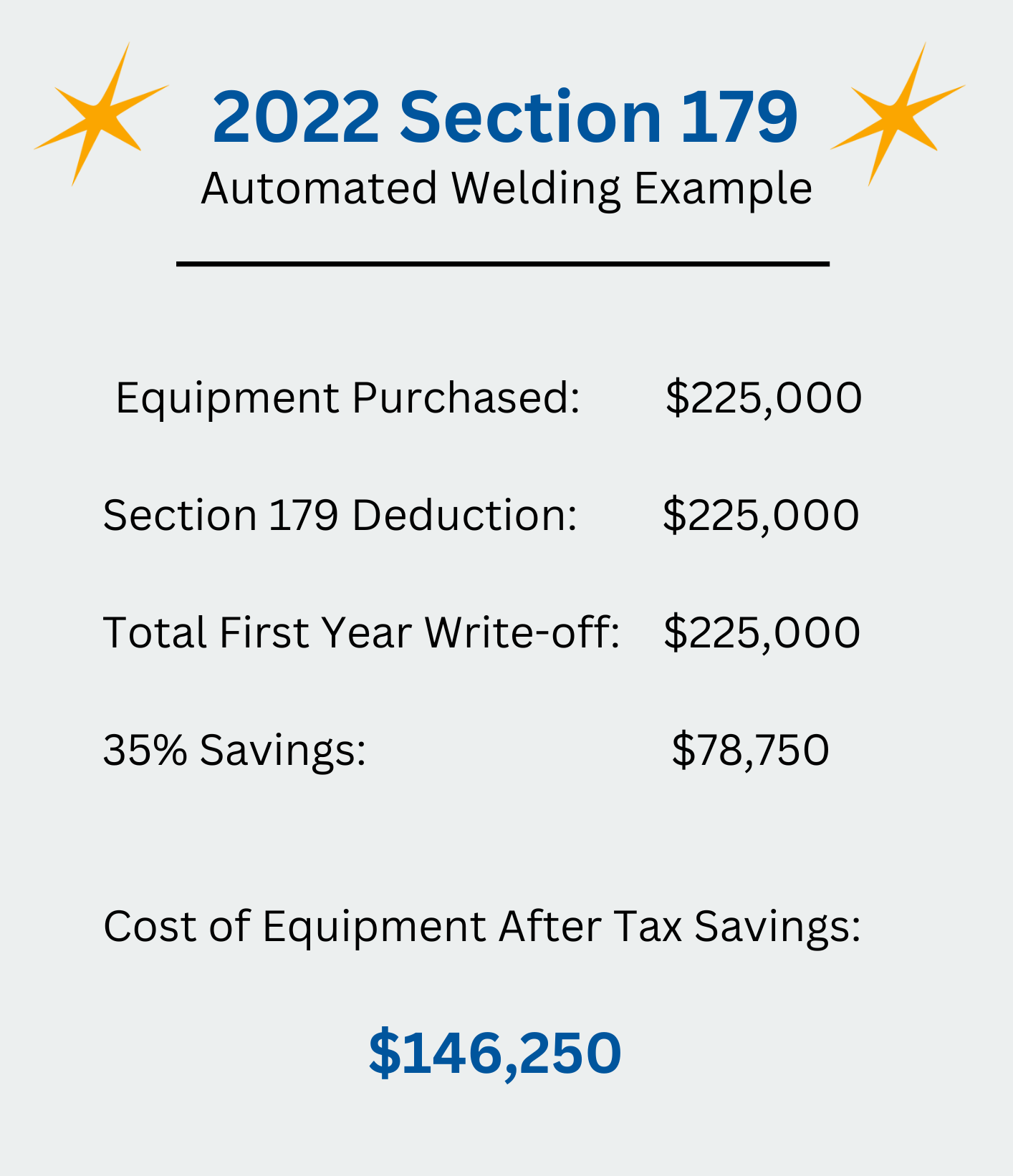

How Much Can You Save?

Let’s look at a real example to determine how much you could save this year.

- Cost of equipment after Bancroft Engineering discounts: $225,000

- Section 179 Deduction: $225,000

- Total First Year Deduction: $225,000

- 35% Saving on Equipment Purchase: $78,750

- Lowered Cost of Equipment After Tax Savings: $146,250

Upgrade to Automated Welding Equipment & SAVE

The Section 179 tax break is available in 2022 and allows you to afford the equipment you need! There’s never been a better time to invest in new equipment.

Bancroft Engineering designs and builds welding equipment such as standardized and custom welding machines and much more out of Waukesha, WI—specializing in stand-alone equipment to fully robotic automated systems. Need help automated your welding process or have a special welding application? Give us a call at 262-786-1880, or email: sales@bancrofteng.com to get started.